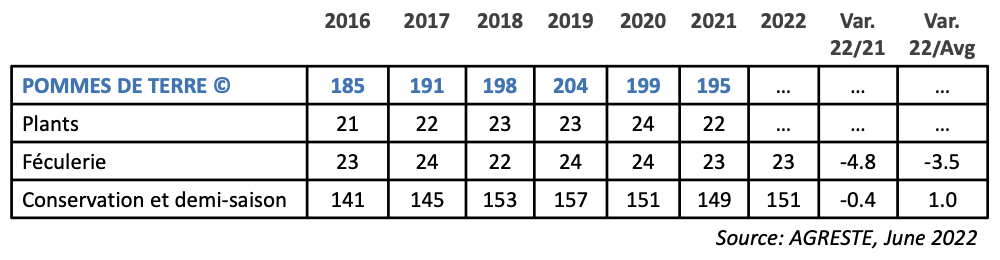

AKV Potato Starch – Market Report

Since December 2021, our customers are facing an extremely turbulent environment, marked by supply chain disruptions, raw material availability issues, unpredictable transportation costs and overall soaring prices. As the summer holidays are approaching, we found it relevant to share our assessment of the current potato starch market, as well as highlighting the major uncertainties affecting the next season.

The Rising Demand for Potato Starch

Corn starch challenges triggered a massive demand on potato starch from last summer, we have been shipping at record levels since September. Our 2 bags packing lines (25 kg PE and 25 kg paper bags) are now booked 5 weeks ahead. The situation is slightly better on big bags and bulk.

As a consequence of this extraordinary level of demand, the European carryover stock (which was significant at the beginning of this season) is expected to be highly depleted at the beginning of the next crop. We forecast this robust demand to last at least until the beginning of 2023, as the situation on corn starch is not expected to improve in the short term.

Over the last three weeks, we have witnessed a surge in requests for quotations for Q3 and Q4 2022 from many new customers. At least 2 European potato starch producers have stopped offering on the spot basis.