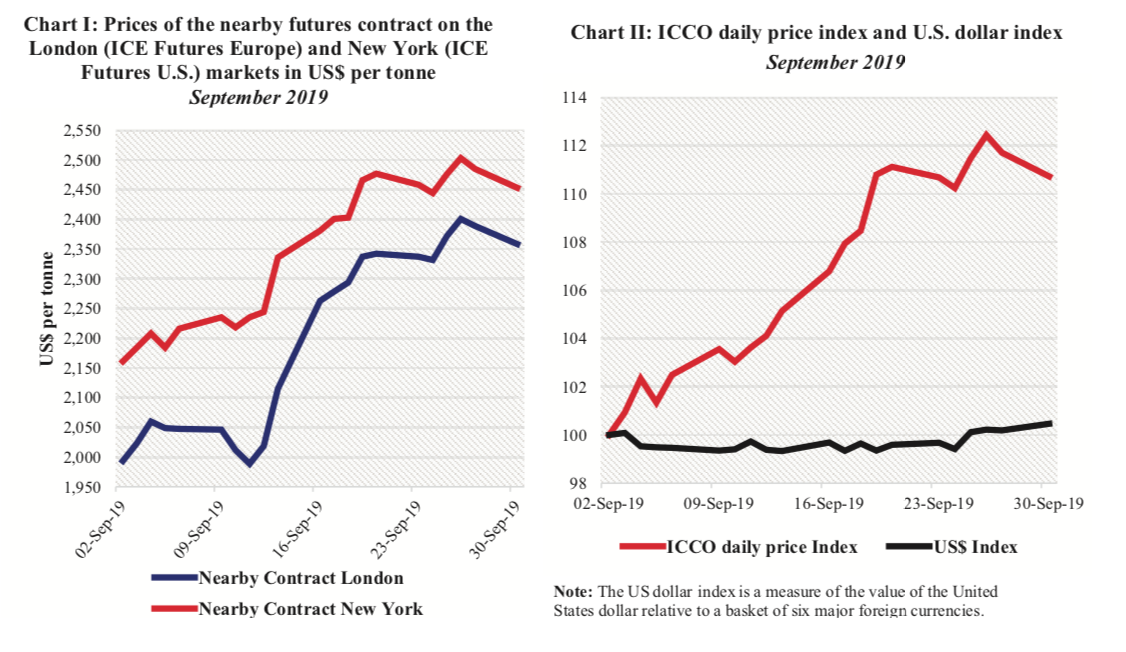

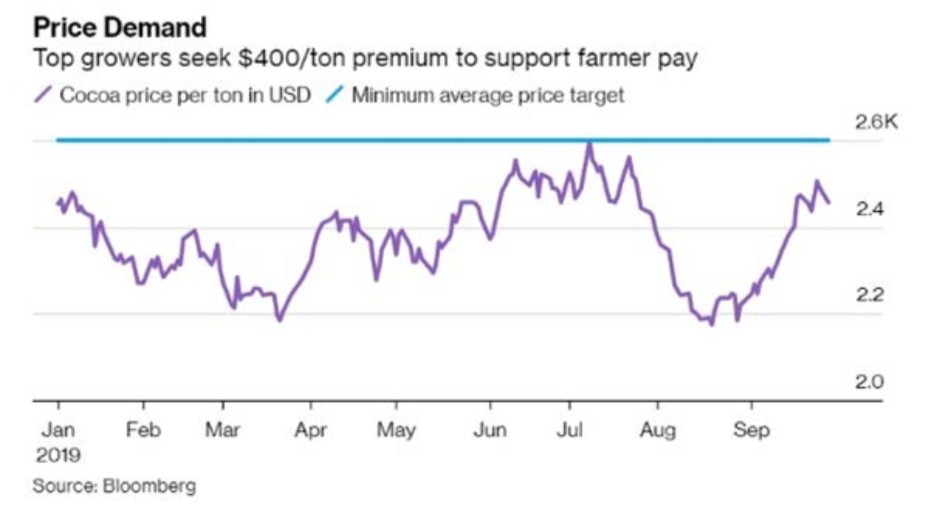

During September, the prices of the nearby contract increased considerably on both the London and New York markets (Chart I). Compared to the first trading session of the month and the closing values observed during the month under review, prices rose by 18% from US$1,993 to US$2,358 per ton in London; and by 14% from US$2,161 to US$2,453 per ton in New York. On closer inspection, the bullish trend started soon after the expiry of the SEP-19 contract, which was pricing the tail end of the 2018/19 season, on 13 September. Indeed, the spreading of Cocoa Swollen Shoot Virus Disease (CSSVD) in Ghana and wetter weather conditions prevailing in Côte d’Ivoire raised concerns over the size of the 2019/20 main crop in the first and second largest world cocoa producers. As a result, cocoa futures contract prices gained strength on both the London and New York markets. As shown in Chart II, the US dollar index stagnated whilst the ICCO daily price index was reinforced by 11% over the reviewed month. Hence, the strengthening of cocoa prices was due to market fundamentals and other factors rather than currency fluctuations.

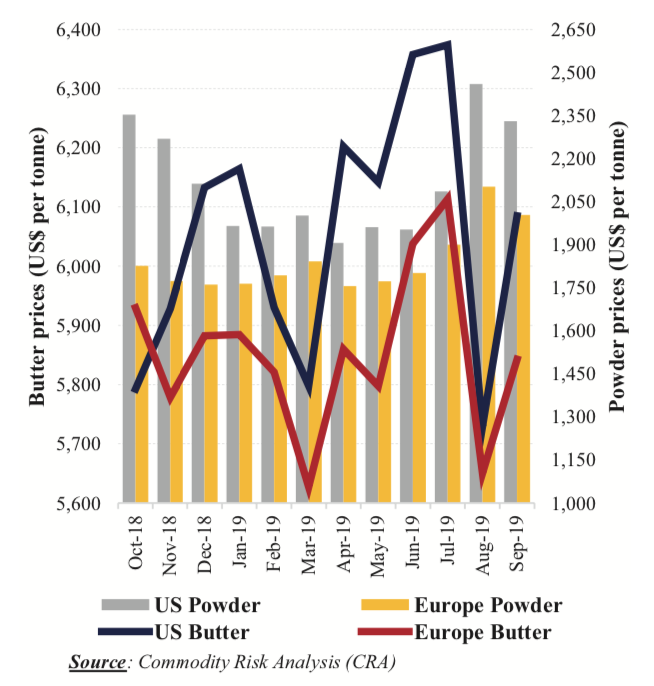

Chart III: Monthly averages of cocoa butter and powder prices in Europe and the United States October 2018 – September 2019

The developments in cocoa butter and powder prices in Europe and the United States, as presented in Chart III indicate that, during the 2018/19 cocoa season, prices for cocoa butter and powder developed in opposite directions on both leading cocoa consuming markets. Indeed, prices for cocoa butter improved by 5% from US$5,792 to US$6,085 per ton in the United States, whilst in Europe they declined by 1.5%, moving from US$5,929 to US$5,843 per ton. Regarding cocoa powder, as compared to the levels reached at the start of the 2018/19 crop year, prices ebbed by 1% from US$2,353 to US$2,330 per ton in the United States. At the same time in Europe, powder prices ascended by 10% from US$1,826 to US$2,003 per ton. In addition, compared to their average values recorded in October 2018, the nearby cocoa futures contract prices progressed by 5% and 9% in London and New York respectively at the end of September 2019. They rallied from US$2,092 to US$2,193 in London, while in New York they escalated from US$2,140 to US$2,341 per ton.