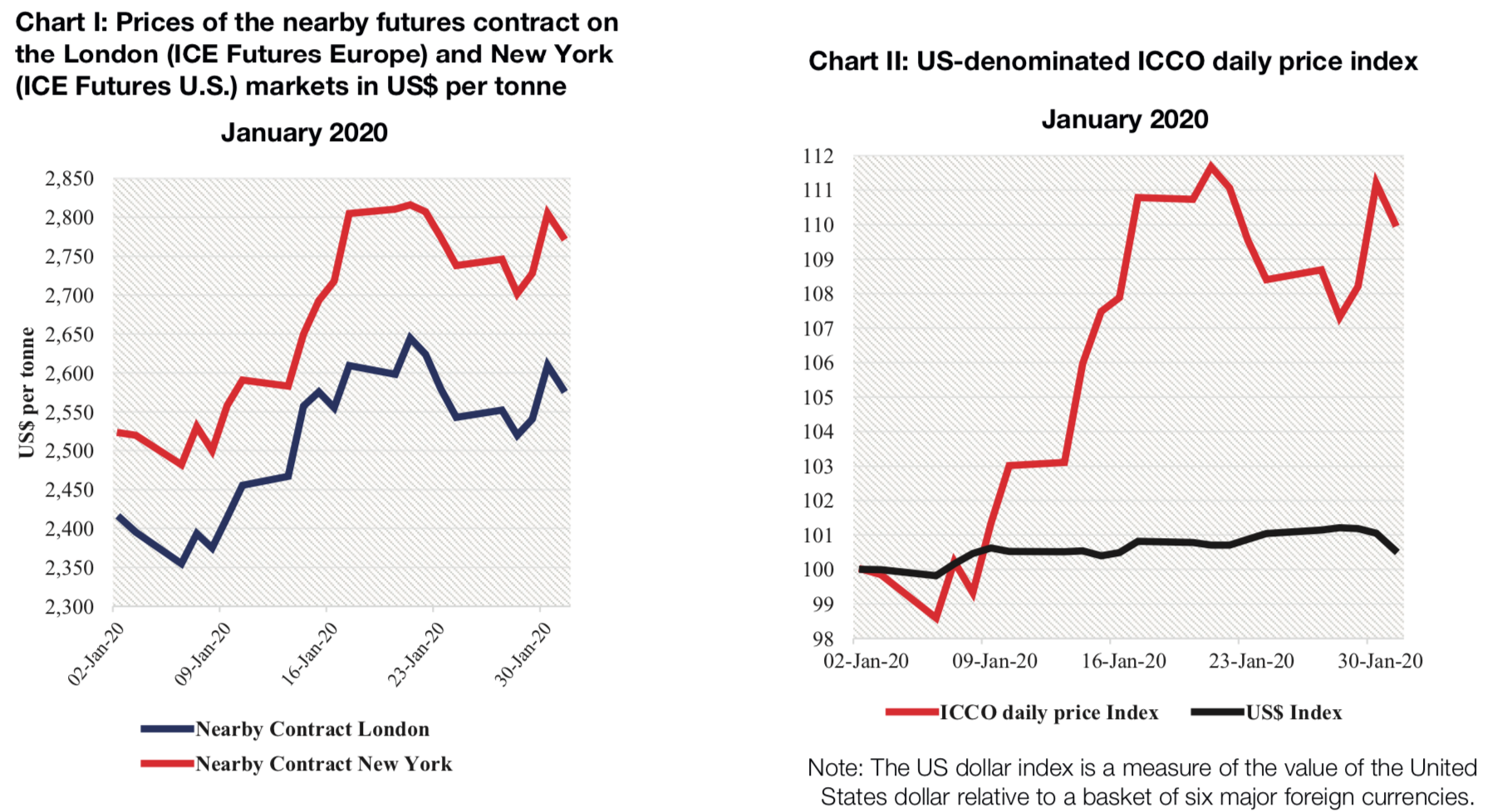

As seen in Chart I, the nearby cocoa futures contracts traded on a strong note on both the London and New York markets during January 2020. This bullish stance was generally a reaction to adverse meteorological conditions that prevailed in West African cocoa growing regions coupled with expectations of higher demand for cocoa in Asia. Consequently, as compared to their settlement values recorded during the first trading session of the month, prices spiked at the end of January by 7% from US$2,413 to US$2,579 per tonne in London and by 10% from US$2,523 to US$2,775 per tonne in New York.

During the first three trading weeks of January 2020, the nearby contract priced stronger on both markets fuelled by concerns of drier growing conditions due to the seasonal Harmattan winds in Côte d’Ivoire and Ghana. In Nigeria, flooding during the development months of the 2019/20 main crop are reported to have caused the spread of black pod disease and pressured down the country’s cocoa production. Over this period, prices increased by 10% from US$2,413 to US$2,645 per tonne and by 12% from US$2,523 to US$2,816 per tonne in London and New York respectively. Next, during the period 22-28 January, prices halted their hike in response to improved weekly supplies recorded by the two-leading producers.

Finally, during the last three trading days of January 2020, prices reverted slightly from their drop and firmed by 2% on both markets lifting from US$2,541 to US$2,579 per tonne in London and from US$2,728 to US$2,775 per tonne in New York. The lack of rain reported in most of the cocoa growing areas in Côte d’Ivoire and Ghana heightened concerns over the future development of the crop. Meanwhile, tighter bean exports were also recorded in Cameroon.

Chart II indicates that, the US dollar index remained virtually flat during the analysis period whilst the ICCO daily price index strengthened by nearly 10% compared to its value at the beginning of January 2020. Hence, the amelioration in cocoa prices was mainly fueled by market fundamentals other than currency movements.