Cocoa Market Report - Q4 2021

INSIGHTS:

- Prices of the nearby contract tumbled by 9% and 6% in London and New York respectively in October.

- Compared to their levels seen a year ago, monitored stocks of cocoa beans in exchange licensed warehouses went up by 19% in Europe and by 51% in the United States.

- Since the beginning of 2021, gradings of cocoa on the London exchange reached 50,430 tonnes against 108,590 tonnes during the corresponding period of the previous year, while in the United States they soared from 25,143 tonnes to 112,066 tonnes.

- Origin differentials generally remained low year-on-year.

- Even though grindings increased year-on-year in Europe, North America and Southeast Asia for the third quarter of 2021, this was not sufficient to absorb excess production.

FUTURES PRICES DEVELOPMENTS

The current report provides a description of the fundamental factors that influenced the movements of cocoa futures prices and focuses on the December-2021 (DEC-21) and March-2022 (MAR-22) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York).

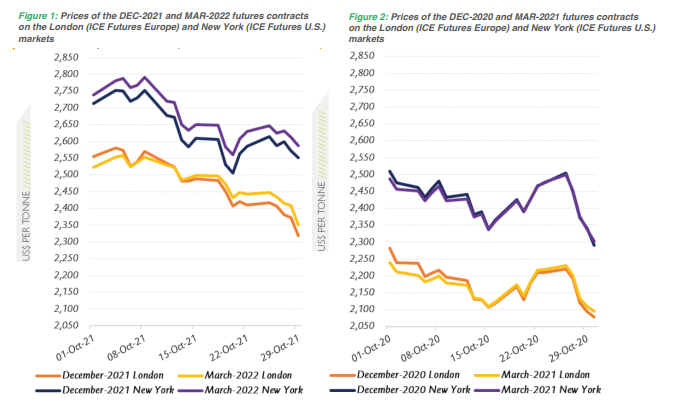

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in October 2021, while Figure 2 presents similar information for the previous year.

Despite the backwardation observed in London over the first half of October, both the London and New York markets were in contango during October 2021, with the DEC-21 contract pricing lower than MAR-22 (Figure 1). Under normal market conditions, futures contracts with later expiries are more expensive than the nearest contracts to account for the cost of carry. The average discount applied on the DEC-21 contract via-à-vis MAR-22 stood at US$9 per tonne on the London market and was lower compared to the discount of US$40 per tonne recorded for the same futures contract on the New York market.

The lower average discount applied to the DEC-21 contract in London was a result of the price configuration change – from backwardation to contango – that occurred during the second half of the month under review, whereas in New York, prices remained in a permanent contango. As shown in Figure 2, a lesser form of backwardation was observed on both sides of the Atlantic over October 2020, in particular over the first half of the month.

The global cocoa market was bearish during the first month of the 2021/22 cocoa year. On both the London and New York markets, prices of the front-month cocoa futures contract witnessed pronounced drops. Compared to the settlement values recorded at the beginning of October 2021, prices of the DEC-21 contract declined by 9% from US$2,555 to US$2,318 per tonne in London, while in New York, they plunged by 6% from US$2,713 to US$2,552 per tonne. Prices declined as a result of excess supply despite the year-on-year increase in grindings for the third quarter of 2021 reported by the main regional cocoa associations.

PRICES OF COCOA BUTTER AND POWDER

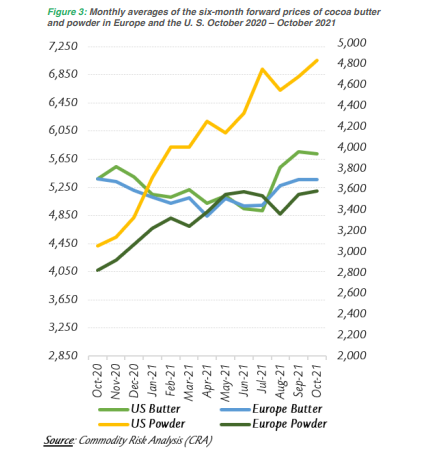

Under normal market conditions, cocoa butter and powder prices move in opposite directions. A decline in the demand for chocolate generates an excess supply of butter and, therefore, a reduction in butter prices. Thus, cocoa processors raise the powder price – which is normally sold below production costs – so as to preserve their margins, since cocoa butter and powder are produced in fixed proportions.

However, Figure 3 shows that, compared to levels seen a year ago, prices of both butter and powder went up in October 2021. While prices of cocoa butter remained virtually flat at US$5,363 per tonne in Europe, they were strengthened in the United States by 7% moving from US$5,374 to US$5,729. In a similar vein, prices of cocoa powder increased in October 2021 compared to their values recorded one year earlier. They rallied on both markets, up by 58% from US$3,058 to US$4,837 per tonne in the United States in October 2021. Over the same period in Europe, powder prices increased by 27% from US$2,825 to US$3,584 per tonne.