The Growing Flexitarian and Vegan Trend

The global rise of the flexitarian diet trend, where consumers are reducing the amount of animal products they consume, combined with the immense success of companies like Beyond Meat and Impossible Foods has drawn a great deal of attention to the plant-based meat category which is growing at a rate of 17% and valued at approximately $3.7 billion in the USA. In comparison, total U.S. retail food sales grew just 2% during the same period. Today 95% of all US grocery stores stock products with a plant-based claim.

One in three Americans now considers themselves a flexitarian and 10% are vegan or vegetarian. This makes up 43% of the U.S. population which is driving the growth of plant-based foods and this number is expected to grow.

In other developing countries veganism is growing at a rate of 600% with the UK leading the charge at 987% in 2017 and in 2018, 1 in 6 new products launched carried a vegan claim.

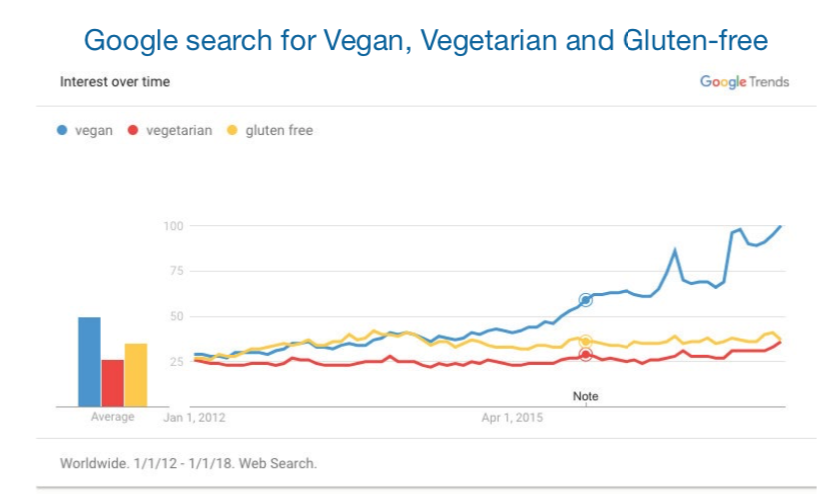

According to a Google search trend analysis, the search for “vegan” quadrupled between 2012 & 2017. It now receives almost 3 times more interest than vegetarian and gluten free searches.

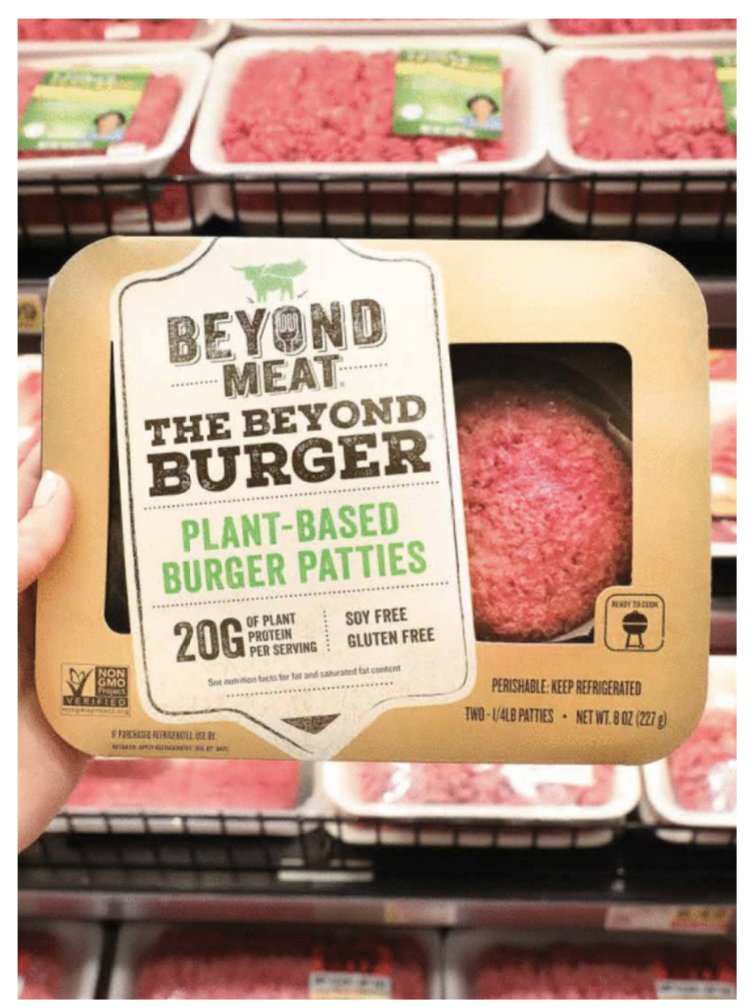

Plant-based food companies have been increasingly targeting their marketing toward flexitarians, who comprise nearly one-third of the U.S. population. The increasing adoption of plant-based products by flexitarians has been one of the primary driving factors in increased demand. For example, Beyond Meat which had the most successful IPO in stock market history, and which is valued at approximately $11 billion estimates that more than 70% of Beyond Burger consumers are flexitarians. 2018 U.S. consumer studies indicate that approximately one-third of U.S. consumers are very or extremely likely to purchase plant-based meat. Among this high purchase intent group, 3% were vegan or vegetarian, 13% were light meat eaters (less than once per day), 50% were medium meat eaters (1-2 times per day) and 34% were heavy meat eaters (more than twice per day). Thus, the trend for flexitarians — and even traditional omnivores — to seek out plant-based meat is projected to grow.

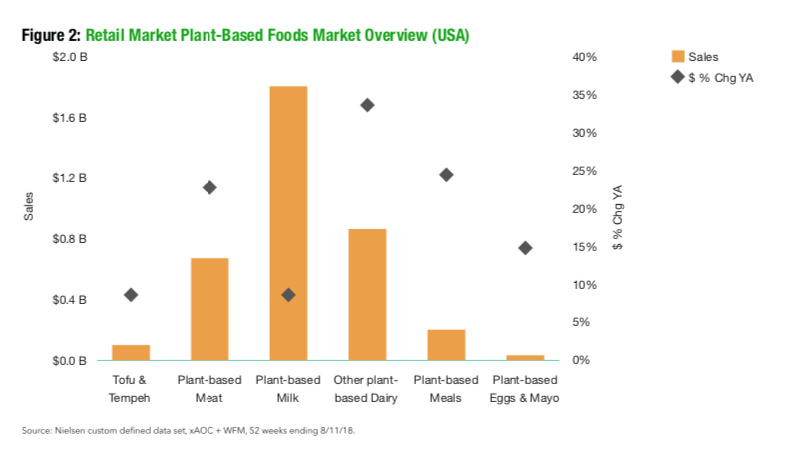

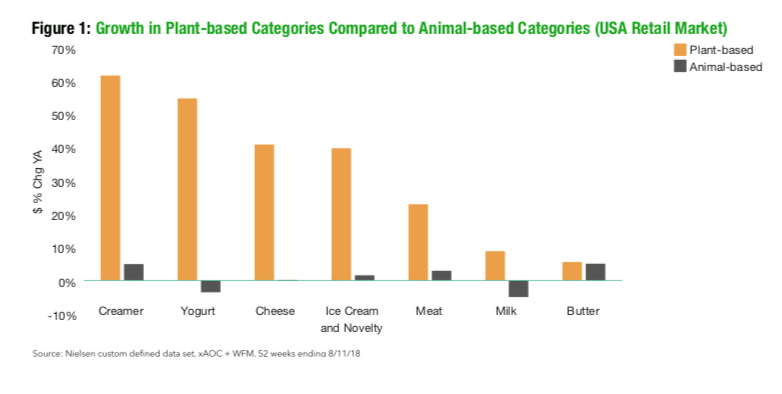

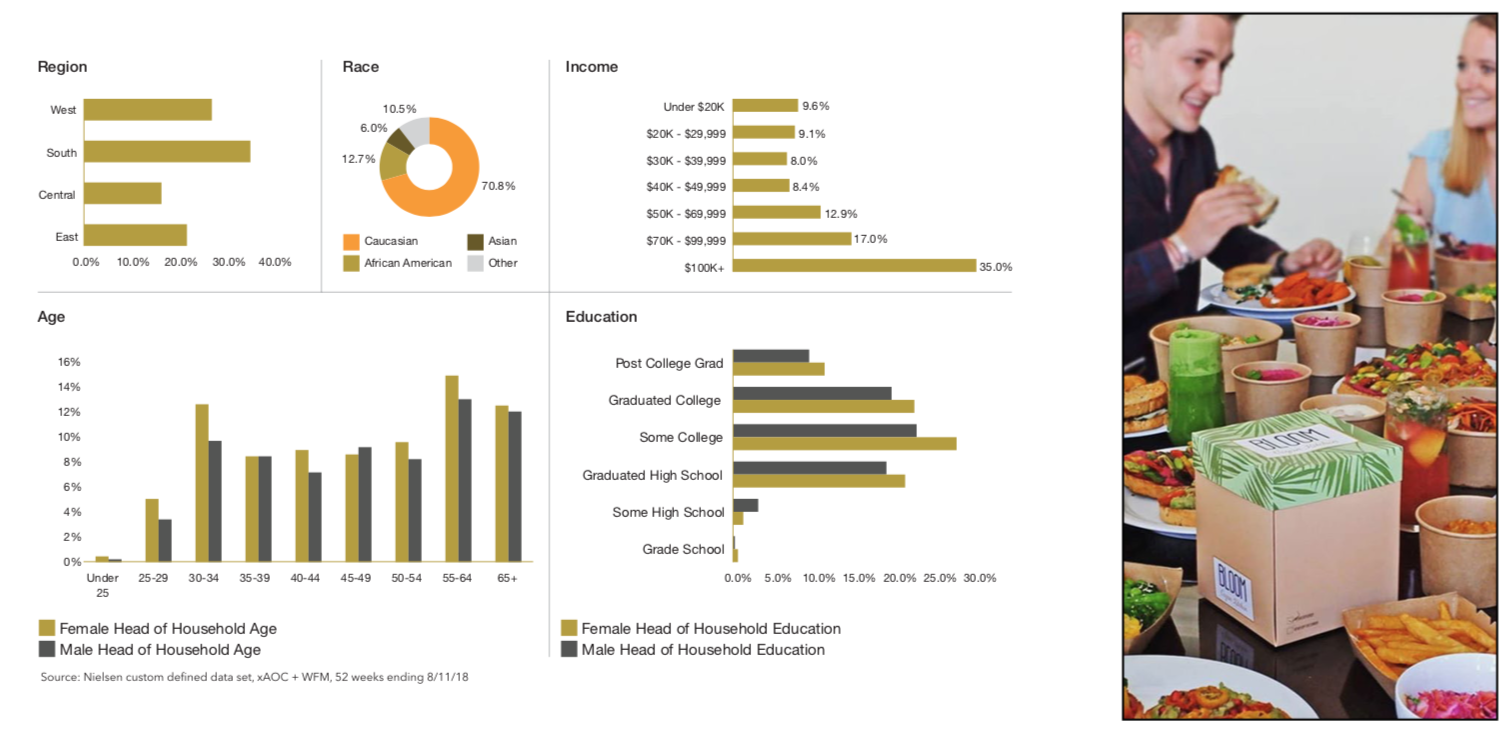

Below are some AC Nielsen research statistics on the Plant-based food retail sector in the USA which indicates a shift away from Animal-based products and towards Plant-based categories:

Note that 37% of American consumers who consume plant-based meat are high-income earners which has created an opportunity for brands to create innovative and healthier products at higher prices and with better margins.

Many of the trends which emerge in western markets soon arrive in the Middle East and the plant-based trend has arrived in the UAE with Beyond Meat burgers becoming widely available at restaurants and retailers and with the world’s largest vegan restaurant opening its doors in Dubai earlier this year. Emirates airlines has also increased its plant-based offerings on all its flights which creates a host of new product opportunities in the foodservice sector.

Saudi Arabia has launched over 65 vegan friendly restaurants and plant-based offerings are increasing on the retail shelves. Key personalities in the region who have turned to veganism such as Prince Khaled bin Alwaleed bin Talal Al Saud, have been instrumental in promoting the dietary shift in the region.

However thus far, all the innovative plant-based products in the region are being imported at staggeringly high prices and this creates an opportunity for local brands to pioneer in this space and saturate the growing demand. We at FSL, believe that we can achieve the “Beyond Meat” level of innovative success for our customers and have been fine tuning our recipe and ingredients to develop our own plant-based meat burgers, chicken tikka nuggets and shawarma strips which are adapted to the local consumers taste profile and which are GMO free and clean label.

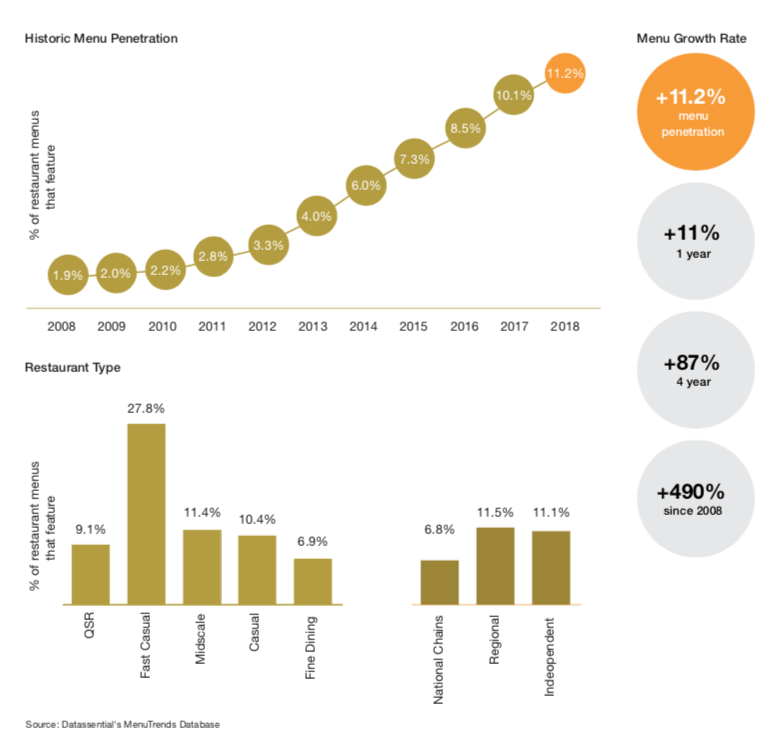

Figure 4: Demand for Plant-Based Foods (Foodservice USA Market)

Please contact us for a sample of our products and read more to learn more about some of the ingredients and products we are offering from new suppliers like Soja Protein to align with the emerging flexitarian and vegan trend.

Figure 5: Beyond Meat Market Cap Per Burger