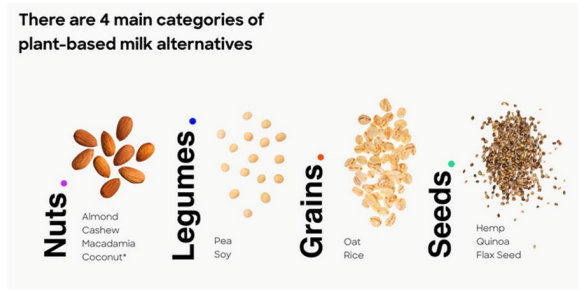

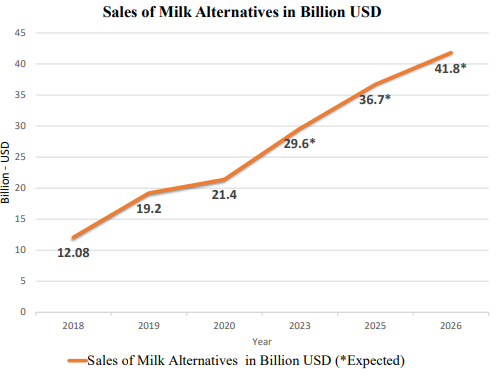

Plant-Based Dairy Alternatives are non-animal derived drinkable and spoonable products which have a similar consistency and sensory profile as milk products but are made from plants such as grains, nuts, legumes and seeds.

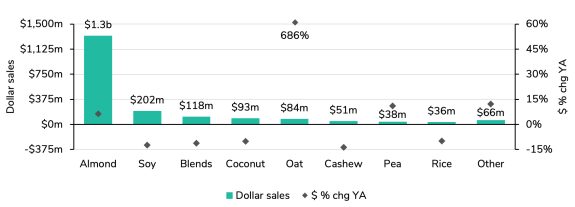

Across all types of plant-milk, plain flavours dominate sales, accounting to 71% of the total value. Flavored milks, RTD coffees and other plant-based beverages are also gaining traction.

In the USA, Plant-Based milks now dominate 15% of the total milk market with almond milks leading the charge and Oat milk experiencing the highest growth.