Cocoa Market Report

INSIGHTS:

- Prices of the front-month cocoa futures contract declined by 4% in London whilst in New York, a 3% plunge was recorded.

- Certified stocks in exchange license warehouses continued to increase in Europe and the United States.

- Compared to 2019/20, cocoa graded on the exchange since the start of 2020/21 went up by 15,110 tonnes from 104,270 tonnes in Europe and by 74,838 tonnes from 16,354 tonnes in the United States.

- Origin differentials further waned year-over-year in June on both sides of the Atlantic.

- Cocoa production in Côte d’Ivoire and Ghana is envisaged to reach unprecedent volumes.

FUTURES PRICES DEVELOPMENTS

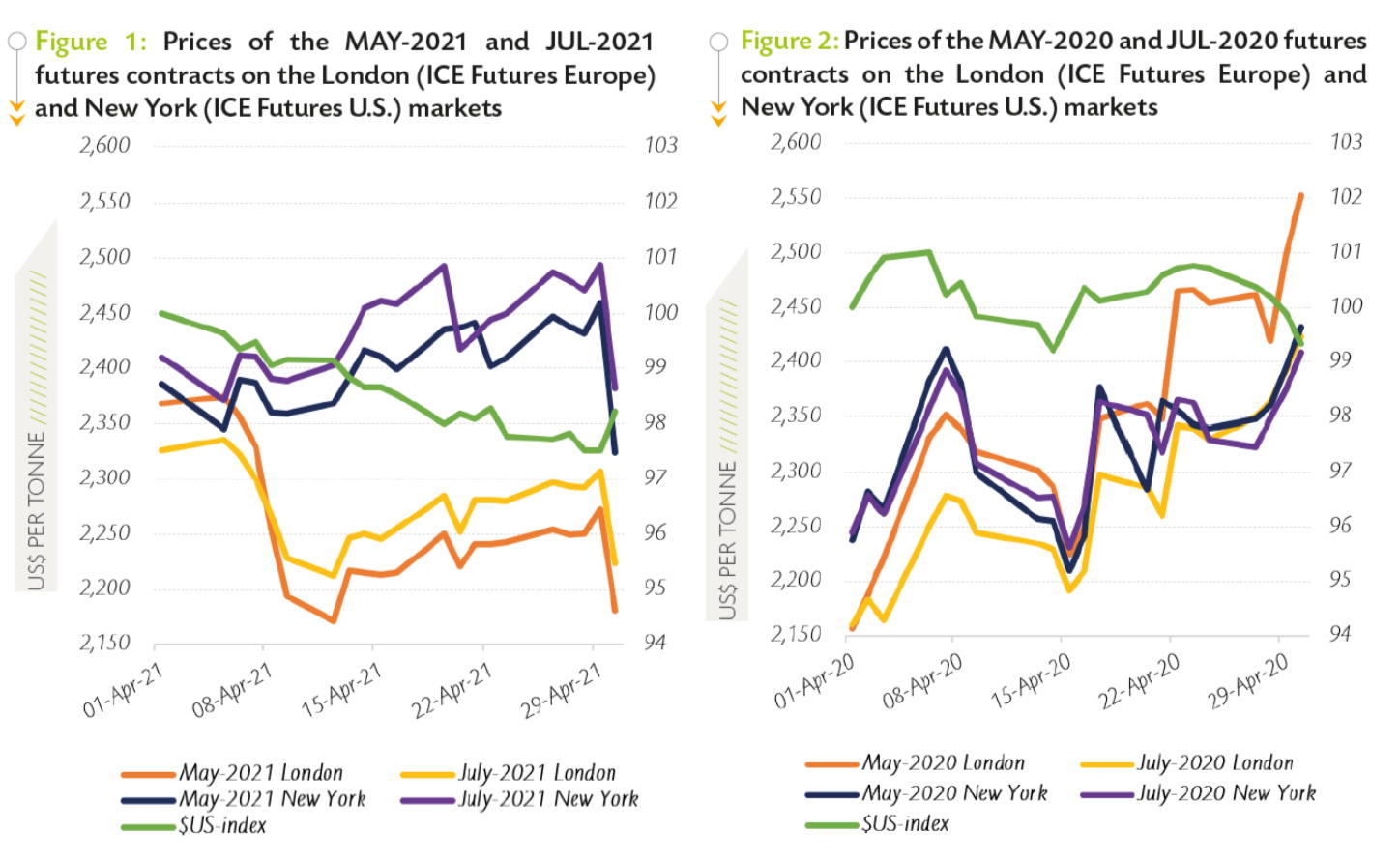

This report on the movements of cocoa futures prices sheds some light on the July-2021 (JUL-21) and September-2021 (SEP-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights into the price for these two specific futures contracts. Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in June 2021, while Figure 2 presents similar information for the previous year. Both figures include the US dollar index to extricate the influence of the strength of the currency on prices.

As seen in Figure 1, the contango situation which was observed in May 2021 continued throughout June 2021. This is directly related to the increase in the volumes of exchange-certified stocks on both sides of the Atlantic. The JUL-21 contract priced with an average discount of US$27 per tonne over SEP-21 in London, while in New York an average discount of US$48 per tonne was recorded on JUL-21 prices compared to SEP-21. It is recalled that a contango is the normal price configuration in futures markets. Contracts expiring at a later date are more expensive as a result of (i) storage and insurance costs;

(ii) interest rates and (iii) the time value of the certification issued by the exchange. Figure 2 shows that both the London and New York markets were bearish, and a backwardation was observed. On the one hand, the declining trend in cocoa prices a year ago was due to lower-than-expected grindings volumes in the midst the COVID-19 pandemic outbreak.

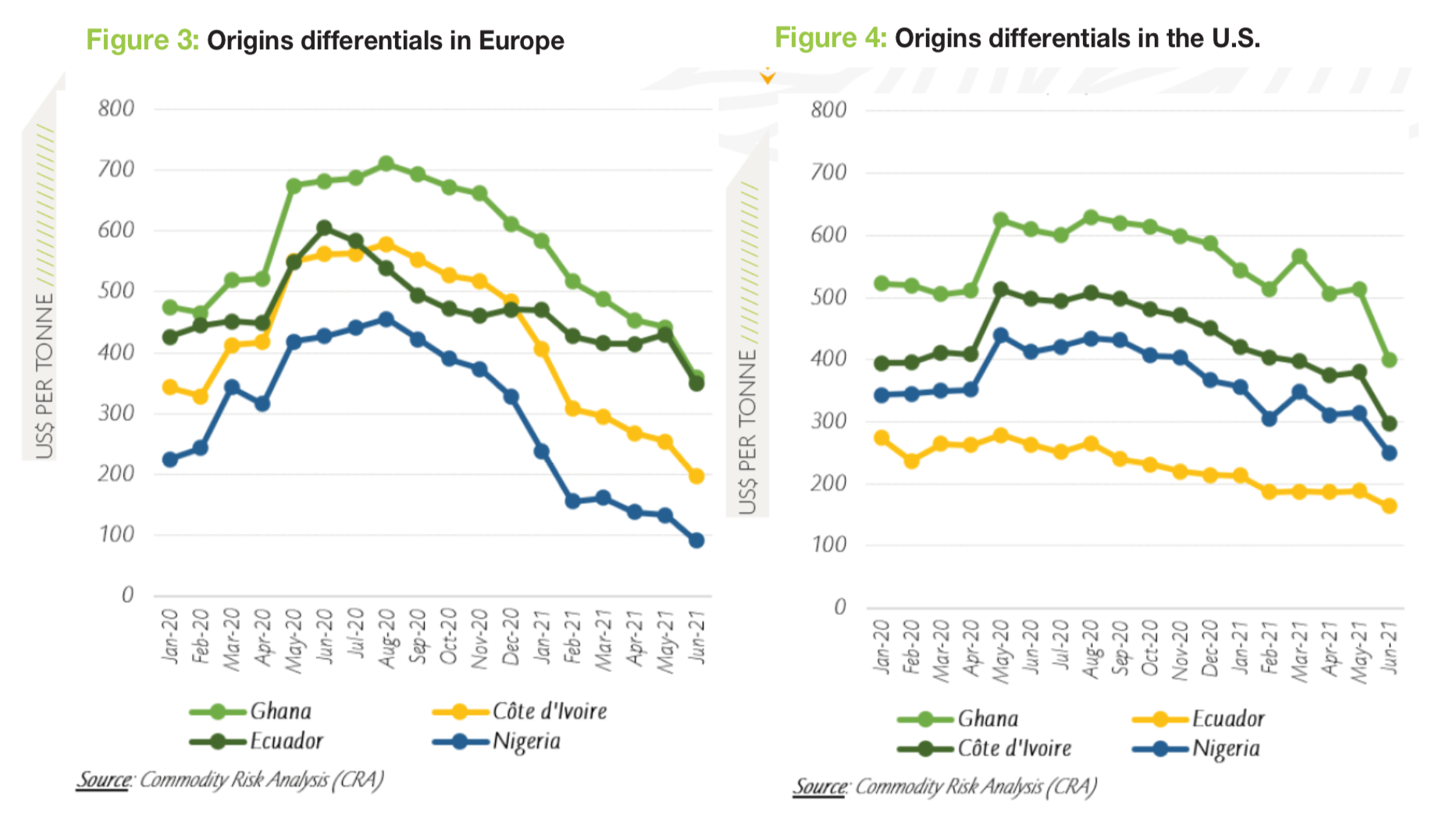

ORIGIN DIFFERENTIALS

As presented in Figure 3 and Figure 4, origin differentials on prices of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador and Nigeria continued to decline in June as compared to their levels recorded at the beginning of the 2020/21 cocoa year. The anticipated market surplus of over 150,000 tonnes because of

the persisting weaker demand pressured down origins differentials.

In Europe, the differential for Ghanaian cocoa was seen at US$358 per tonne in June 2021, 47% lower compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential was slashed by 63% from US$527 to US$197 per tonne for Ivorian cocoa beans. A 77% reduction from US$390 to US$91 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential dwindled by 26% from US$472 to US$350 per tonne.

Turning to the U.S. market, cocoa beans from Ghana recorded a differential of US$400 per tonne in June 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 38% from US$481 to US$296 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 29% from US$231 to US$164 per tonne, while a 39% reduction from US$407 to US$250 per tonne was seen in the origin differential for Nigeria.

PRICES OF COCOA BUTTER & POWDER

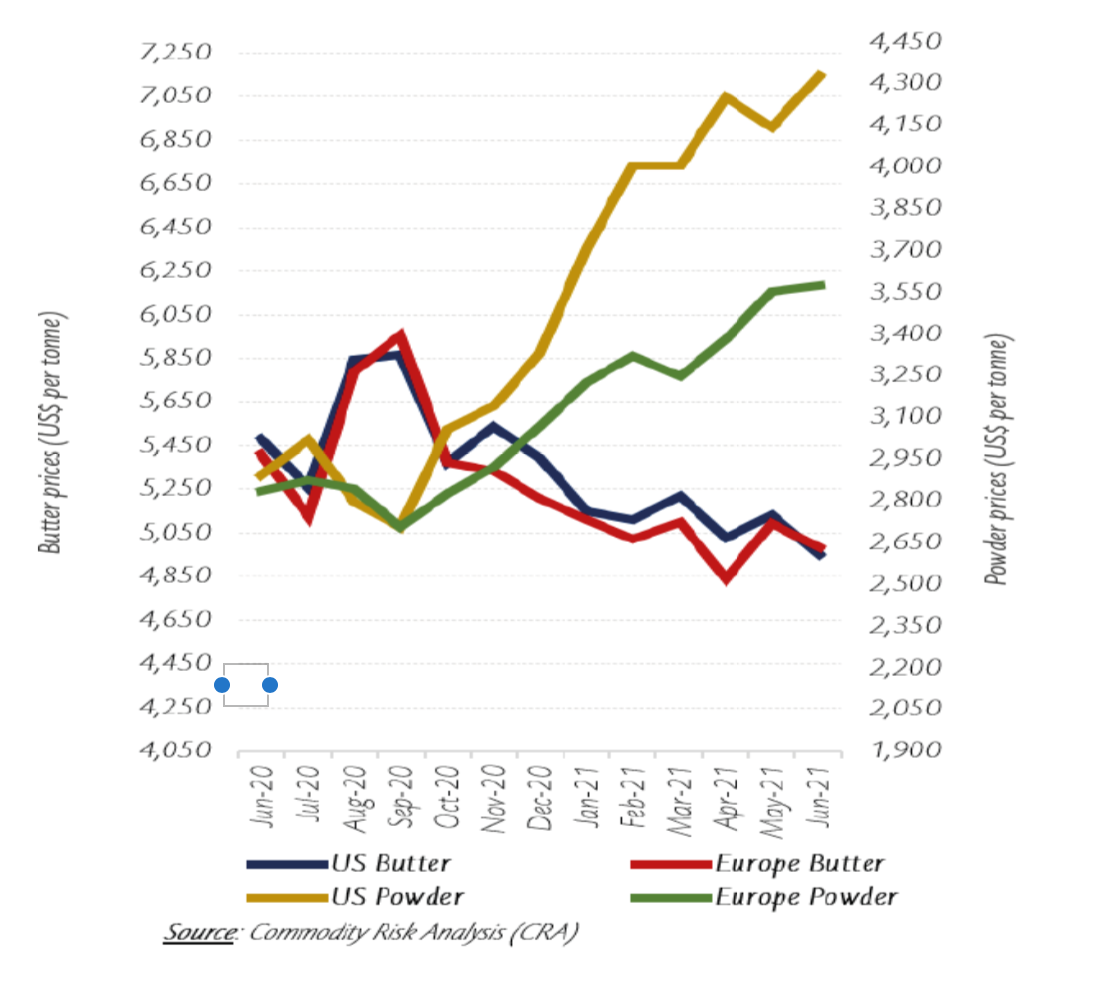

The inverse correlation which exists under normal market conditions between cocoa butter and powder prices is hereby presented in Figure 5. On the one hand, expectations of increasing demand for cocoa powder sustained price hikes. On the other hand, the dip observed in butter prices was in line with the current cocoa market conditions according to which the global market is journeying toward a supply excess. This will result in price declines for cocoa beans and subsequently prices of cocoa butter, as prices of beans and butter are positively correlated.

Compared with the average price recorded during June 2020, prices for cocoa butter dropped by 8% in Europe and by 10% in the United States during June 2021. Indeed, prices for cocoa butter dropped from US$5,483 to US$4,952 per tonne in the United States, while in Europe they weakened from US$5,413 to US$4,986 per tonne.

As opposed to the movements of cocoa butter prices, cocoa powder prices increased in June 2021 compared to their values recorded a year ago. They rallied on both markets, up by 50% from US$2,893 to US$4,327 per tonne in the United States in June 2021. Over the same period in Europe, powder prices increased by 26% from US$2,833 to US$3,574 per tonne.